This is ideal for growing businesses that don’t want to waste time on technical issues. However, they were not as comprehensive as what we found in our review of QuickBooks Online. Phone support is not available immediately; you must contact customer service first via email or live chat. However, the upside is that Xero does not leave users hanging with long wait times. Instead, the company will call you back at a time convenient for you. Xero connects to your bank and credit card accounts and imports data daily, so we really appreciate that it protects your sensitive business data with bank-grade encryption.

Entry-level plan limits

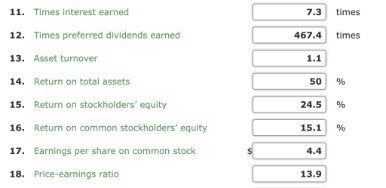

These reports help small business owners identify areas for improvement and make evidence-based decisions in real time. Xero doesn’t offer as many pre-built reports compared to Xero alternatives such as QuickBooks. FreshBooks is another one of our favorites for small businesses — especially freelancers. It has unlimited customizable invoices, a client portal, built-in project and time tracking and buyer entries under perpetual method financial accounting a highly rated mobile app.

If using multiple currencies is a priority to you, consider other platforms that offer this capability at a lower cost. Zoho, for example, is accounting software with a free invoice platform that allows you to bill in multiple currencies. Merchant Maverick’s ratings are editorial in nature, and are not aggregated from user reviews. Each staff reviewer at Merchant Maverick is a subject matter expert with accounting coach cash flow statement experience researching, testing, and evaluating small business software and services.

Why We Chose Xero as the Best for Growing Businesses

This feature is available on all pricing plans; which I appreciate since some accounting software charges extra for mobile receipt capture. Employees can submit a reimbursement request as soon as their receipts are uploaded, and the business owner can track expenses totals by category as they are submitted (Figure C). Xero offers the option to add full service payroll support from Gusto to any plan. This Gusto-Zero integration starts at $40 per month plus $6 per employee. If you are looking for payroll software in addition to accounting software, be sure to check out our guide to the best payroll software for 2024.

Additionally, Xero offers a 30-day free trial, so you and your employees can test the software before you buy it. Not every accounting software provider offers a free trial, so we appreciate this feature. Unlike many other accounting applications, Xero does not base its pricing on the number of individuals who need access. In our view, this is one of Xero’s key differentiating factors, making it a great choice for growing businesses that are rapidly adding new employees. When testing what is a provision for income tax and how do you calculate it the software, we found Xero easy to navigate, with an intuitive and user-friendly interface. Keep in mind that the ability to use multiple currencies in the software and invoice is limited to the company’s highest tier, at $70 per month.

Create a TechRepublic Account

Join the thousands of people like you already growing their businesses and knowledge with our team of experts. We deliver timely updates, interesting insights, and exclusive promos to your inbox. We have financial relationships with some companies we cover, earning commissions when readers purchase from our partners or share information about their needs. Our editorial team independently evaluates and recommends products and services based on their research and expertise. FreshBooks charges $17 per month and QuickBooks charges $30 per month). However, the best option and price point will depend on the specific capabilities and features you are looking for.

This screen also shows automatic payment reminder information, such as the relevant email address and the date and time. One cool new Xero feature is its beefed-up Inventory Plus management system. This system allows you to manage inventory across multiple locations and channels.

- However, the upside is that Xero does not leave users hanging with long wait times.

- In addition to the features on the Early plan, the Growing plan includes bulk transaction reconciliation to speed things up.

- Data is backed up daily across various servers, and regular security audits are performed.

- This feature is available on all pricing plans; which I appreciate since some accounting software charges extra for mobile receipt capture.

- We researched and analyzed dozens of the best accounting and invoicing software solutions to help small businesses choose the right accounting software for their needs.

- If you are looking for payroll software in addition to accounting software, be sure to check out our guide to the best payroll software for 2024.

We compared the two options in terms of their key features, pricing and customer service to help you decide which is right for your business. However, Wave’s features are more limited than many competitors in order to keep the price low, so it may not suffice for growing businesses. The number of users is also technically unlimited, but FreshBooks does charge an extra fee of $11 per user per month. There is limited tax support, limited invoice templates, no built-in payroll, and a steep learning curve. Multiple pricing increases over the years have driven up the cost of the software, and customer support isn’t the best.

What is better: QuickBooks or Xero?

In addition to reaching out for live help, you can access valuable online support resources, including videos, a blog, podcasts, small business guides and training courses. Xero recently streamlined the ability to search for help while using the software, so you don’t have to leave the site. Read our 2024 Xero review to find out if it’s the right solution for your business. All pricing plans are in ZAR including VAT and cover the accounting essentials, with room to grow. We really liked Xero’s unique History & Notes feature, which presents an activity report at the bottom of every transaction screen. For example, you can see if the invoice was copied from a quote, who created and approved it, and when they created and approved it.

Transactions initiated by app partners may automatically contribute to your invoice limit. Hubdoc is included in Xero Early, Growing and Established plans as long as it’s connected to your Xero subscription. Your use of the Xero services is subject to the Xero Terms of Use and your use of the Hubdoc services is subject to the Hubdoc Terms of Use. †Invoice limits for the Starter plan apply to both approving and sending invoices.